You Can Ketchup More Fries with Money

Rhonda Rhea's posts always go deeper than one might think at first. Such is the case in this Stewardship UPGRADE.

"Don’t even try to pretend," Rhonda says. "Don’t pretend you don’t know that the hamburger and the French fries have to come to an end at exactly the same time."

"Don’t even try to pretend," Rhonda says. "Don’t pretend you don’t know that the hamburger and the French fries have to come to an end at exactly the same time."

I (Dawn) was intrigued by Rhonda's title until I saw a longer version and scanned the article.

The whole title is: "You Can Ketchup More Fries with Money—And Catch Fools with It Too."

Ah... I see. This is about stewardship!

Rhonda continues . . .

Bite of hamburger. Bite of fry. Burger. Fry.

Once you invest your money in the full meal deal, it feels like bad stewardship if any one bite doesn’t live up to the others.

Burger, fry, burger, fry.

These are the rules, people. Hey, it’s not like I make this stuff up.

When you think about it, it’s the only cultured way to eat a burger.

Of course, “culture” and “full meal deal” don’t always go together like… well… like burgers and fries.

I was eating my burger, fry, burger, fry the other day and I happened to glance over at the ketchup packet and noticed it said, “FANCY.”

Well, that was just frustrating. I felt underdressed the whole rest of the meal.

And you don’t want to feel underdressed when you have to go back for that extra order of fries. Because when you’re explaining to the kid taking your money that you had too much burger at the end of your fries, you don’t want to look stupid.

When it comes to dealing well with money, there’s always a challenge not to get stupid. Not because money is evil. Because loving it is.

And it’s a trap.

“But those who want to be rich fall into temptation, a trap, and many foolish and harmful desires, which plunge people into ruin and destruction. For the love of money is a root of all kinds of evil, and by craving it, some have wandered away from the faith and pierced themselves with many pains” (1 Timothy 6:9-10, HCSB).

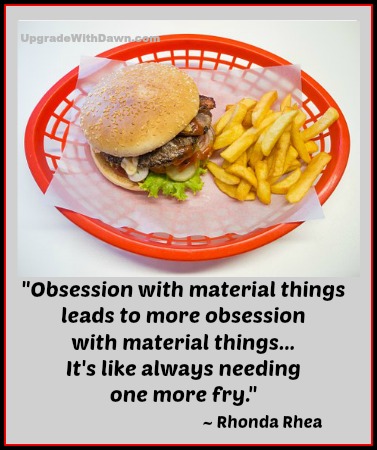

Obsession with material things leads to more obsession with material things, and then more—a trap of our own spiraling desires. It’s like always needing one more fry.

How sobering to read verse 9. Our craving for money can lead us away from our faith and right into all kinds of piercing pain. Foolish sinfulness. Certainly nothing sophisticated about that.

Paul tells us to “run from these things” (verse 11). Run away from that temptation to focus on getting rich.

People who already enjoy wealth are not safe from the trap either. It can become all too easy to find security in a big bank account rather than in Christ.

Verse 17 says, “not to be arrogant or to set their hope on the uncertainty of wealth, but on God, who richly provides us with all things to enjoy.”

When Paul tells us to run from the love of money and all the other evils, he doesn’t just leave us running wildly off without direction.

“But you, man of God, run from these things, and pursue righteousness, godliness, faith, love, endurance, and gentleness" (verse 11).

As we pursue all the right spiritual things, our view toward all things physical comes more clearly into focus.

When we’re not distracted by loving or trusting in money and things, we see what’s real.

“Instruct them to do what is good, to be rich in good works, to be generous, willing to share, storing up for themselves a good reserve for the age to come, so that they may take hold of life that is real,” (verse 18).

Investing in Kingdom work. That’s real investing.

Incidentally, anytime you’ve invested the meal deal and you’re feeling a little unsophisticated… ketchup. It’s the fancy condiment.

Anything else just won’t cut the mustard.

Are you pursuing the physical or the spiritual? How is pursuing the spiritual a better "deal"?

Rhonda Rhea is a humor columnist, radio  personality, speaker and author of 10 books, including How Many Lightbulbs Does It Take to Change a Person?, Espresso Your Faith - 30 Shots of God's Word to Wake You Up, and a book designed to encourage Pastor's Wives (P-Dubs): Join the Insanity. Rhonda, a sunny pastor's wife, lives near St. Louis and is "Mom" to five grown children. Find out more at www.RhondaRhea.com.

personality, speaker and author of 10 books, including How Many Lightbulbs Does It Take to Change a Person?, Espresso Your Faith - 30 Shots of God's Word to Wake You Up, and a book designed to encourage Pastor's Wives (P-Dubs): Join the Insanity. Rhonda, a sunny pastor's wife, lives near St. Louis and is "Mom" to five grown children. Find out more at www.RhondaRhea.com.

Graphic adapted, courtesy of eisenmenger at Pixabay.

Post a Comment → Posted on

Post a Comment → Posted on  Tuesday, June 6, 2017 at 8:01AM

Tuesday, June 6, 2017 at 8:01AM  Finances,

Finances,  Financial Stewardship,

Financial Stewardship,  Financial Wisdom,

Financial Wisdom,  Hamburger and Fries,

Hamburger and Fries,  Investments,

Investments,  Materialism,

Materialism,  Rhonda Rhea,

Rhonda Rhea,  Stewardship,

Stewardship,  Temptation,

Temptation,  Upgrade with Dawn Upgrade Your Life

Upgrade with Dawn Upgrade Your Life  Priorities,

Priorities,  Stewardship

Stewardship